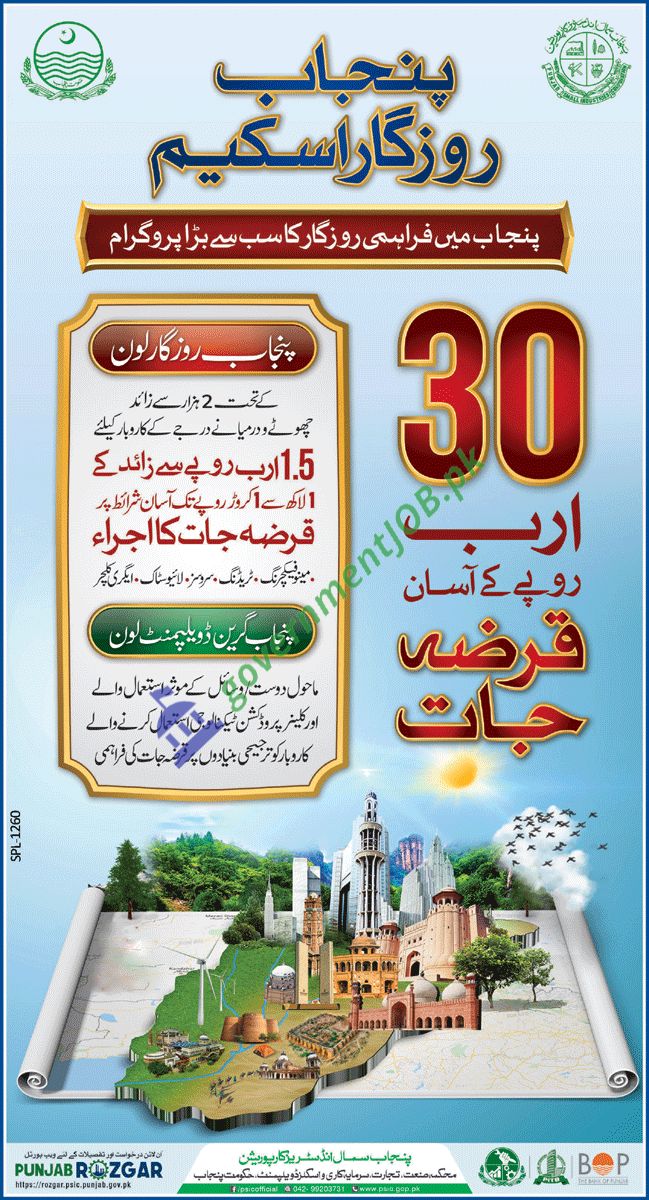

Introduction Punjab Rozgar Scheme./Program 2022

The Punjab Small Industries Corporation (PSIC) is a statutory body corporate with the purpose of promoting small-scale and cottage industries in the province by providing credit, issuance of credit guarantees to the scheduled banks, access to develop infrastructure, business advisory services, and marketing.

Table of Contents

What is the Punjab Rozgar scheme?

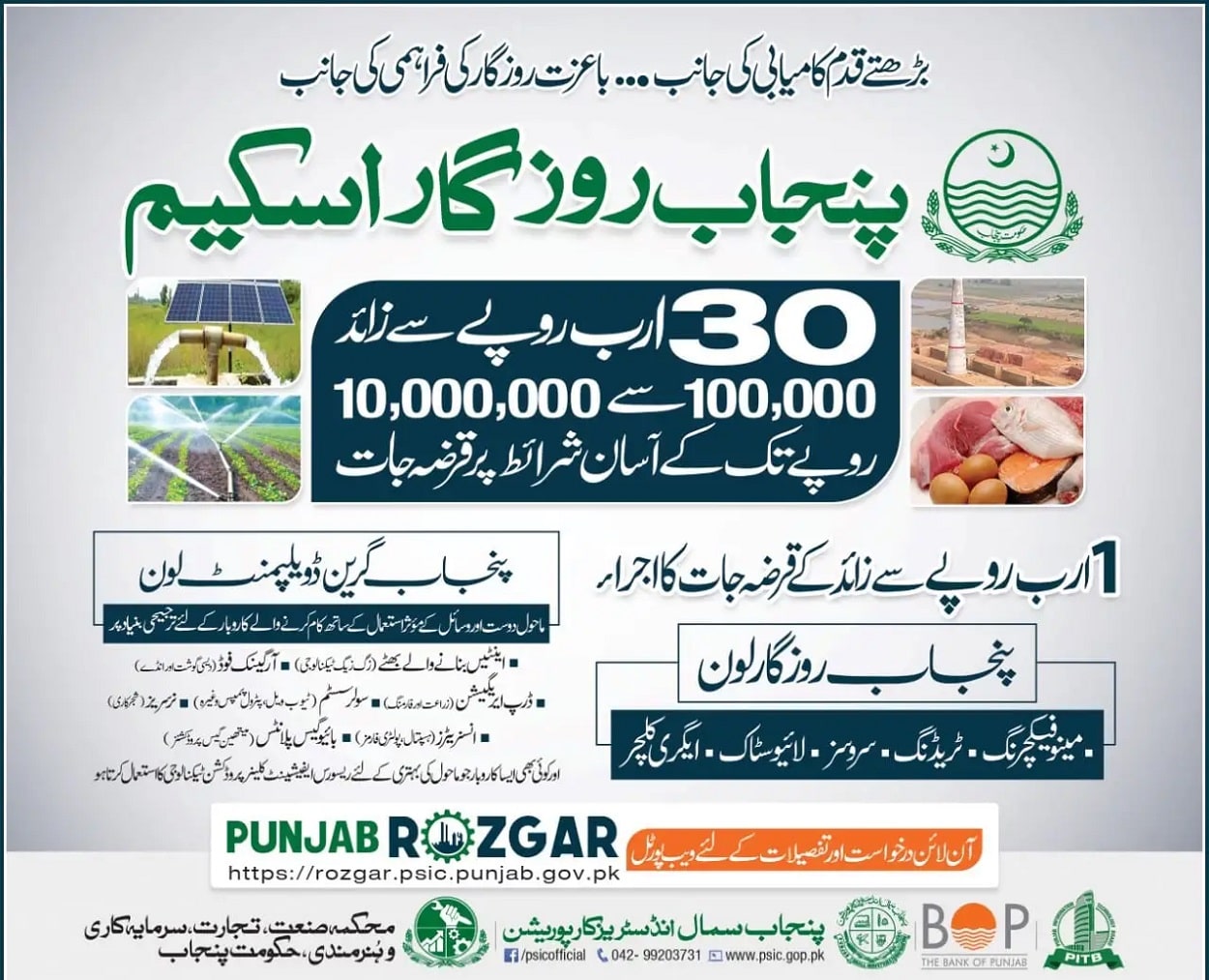

The Government of Punjab launched the Punjab Rozgar Scheme, its flagship program, at a total cost of Rs. 30,000.00 million (Rs. 30 billion), to offer subsidized loan facilities to startups and established MSMEs in partnership with Commercial Banks.

Scope

The Punjab Rozgar Scheme would provide financial assistance to new and established enterprises in Punjab, with a special focus on those affected by COVID-19. The trade, service, manufacturing, agricultural, and livestock industries are prioritized in the plan.

Financial assistance will also be given under the Punjab Green Development Program to Micro and other businesses that seek to implement resource-saving and cleaner manufacturing techniques to enhance environmental performance.

Target Group

- Graduates from universities or colleges with a flair for entrepreneurship TVET diploma or certificate holders with technical or vocational training

- Artisans and skilled workers

- Existing Businesses

- The environmental performance of the activities of micro and other firms that seek a loan must implement resource-efficient and cleaner production methods or any Green / Environmentally Friendly intervention.

Eligibility Criteria

The following eligibility criteria will be adhered to to process the loans under Punjab Rozgar Scheme:

- Age: 20 to 50 years

- Gender: Male / Female / Transgender

- Resident: Citizen of Pakistan, Resident in Punjab, verified through CNIC

- Business Location: Punjab

- Business Type: Sole Proprietor, Partnership, or any business fulfilling other eligibility criteria

- Must have a clean e-CIB / Credit History

- For startups / new businesses

- Having a viable business plan

- For existing businesses

- Having a viable business plan with a focus to sustain the impact of COVID-19

- Having Valid CNIC

- Any other parameter to be set by Punjab Small Industries Corporation (PSIC) / Government

Terms & Conditions

| FEATURE | DESCRIPTION |

| Loan limit |

Under Punjab Green Development Program, the limit of a loan will remain the same. However, preference will be given to the micro-enterprises, ready to adopt the environment-improving technology, and having up to 10 numbers of employees. |

| Purpose of loan |

|

| MSME Sector |

|

| Processing fee | Rs. 2000/- (non-refundable) at the time of submission of the application |

| Tenure of loan / Repayment Period | From 02 to 05 years including a grace period |

| Grace period | Up to Six (06) Months (However, the markup will be charged during the grace period) |

| Type of loan | Term loan as per bank policy and working capital |

| Cost of Capital | |

Cost of Capital to be paid by Borrower:

| |

| Debt: Equity | 80:20 (For males) 90:10 (Women, Transgender and Differently abled) (Meaning thereby 20% / 10% of the project cost will be invested by the borrower) |

| Disbursement of loans | In installment(s) as per approved business plan |

| Security of loan | 1. Security for Clean Lending i. Security for loan limit from Rs. 100,000/- to Rs. 500,000/- Personal Guarantee of the borrower along with the net worth statement. ii. Security for loan limit from Rs. 500,001/- to Rs. 1,000,000/- · Personal Guarantee of the borrower along with at least one, Third Party guarantor with overall net worth collectively equal to the size of the loan applied. (Third Party should be a citizen of Pakistan and resident of Punjab having a valid CNIC and must not be older than 55 years. Moreover, the e-CIB of the third party should be clean i.e. it should not have any overdue or write-off history) OR · Guarantee of Government employees of BS-10 and above along with the personal guarantee of the borrower. (Departmental guarantee of the government employee will be mandatory) Net Worth / Wealth Description and Calculation Criteria: · Net Worth may be in the form of Tangible Assets i.e Property or Vehicle ownership and may be assessed as follows: a. Property may be valued at respective DC rate. OR b. Property valuation may be established from the Wealth Tax statement. OR c. Evaluation by Pakistan Banks Association (PBA) approved evaluator/agent OR d. Vehicle valuation shall be invoice price less depreciation (10% for each passing year). 2. Security for loan limit from Rs. 1,000,001/- to 10,000,000/- Mortgage of Assets Asset description a. Residential / Commercial / Industrial / Agricultural Property/vehicle has a clean title and clear access (acceptable to the bank) and valued by banks approved appraiser as per the bank’s policy. b. The property should be in the name of the borrower or blood relative of the individual/proprietor/partners. c. Documentation shall be as per bank credit policy / legal division. Charge / hypothecation on fixed / current assets as per internal / external regulations. |

Schedule of Charges

The schedule of Charges to be paid by the Applicant / Borrower will be as under:

| Application Processing Fee | Rs.2000/- (non-refundable) at the time of submission of the application |

| Valuation / legal / documentation charges inclusive of revenue stamps, Government duties / fee etc. | At Actual Rate |

| Insurance ( if applicable) | At Actual Rate |

| Partial / Balloon / Early Settlement Charges | NIL |

| Late Installment Payment Charges

| Rs. 1 per 1000 per day on the principal amount to be calculated from monthly installment from the due date till date of actual payment |

Formats of Documents

- Personal Net Worth Statement Format

- Third Party Net Worth Statement Format

- Department Verification/ Guarantee Letter Format

- Project Feasibility/ Business Plan/ Financial Feasibility Format

Instructions

Before beginning your application, you must have scanned copies or clear, visible images of the following documents available:

- picture of the entire face

- the front of CNIC

- the back of CNIC

- If and when relevant, the most recent educational degree or certificate (Matric, Intermediate, Bachelor, Master, Ph.D., etc). (if applicable)

- certificates of experience (if applicable)

- License or membership in a trade association (if applicable)

- Security documents that must be scanned in order to apply for a loan

Before beginning your application, you must have the following information on hand:

- Consumer ID of an electricity bill installed at your current residence, if you don’t already have one, please register at https://iris.fbr.gov.pk. FBR National Tax Number (optional).

- Consumer ID for the electricity meter at your place of business (if applicable)

- Any car that is registered in your name with a registration number (if applicable)

- An estimate of monthly business revenue, expenses, household expenses, and other income in the case of a new business

- Actual Monthly Business Income, Business Expenses, Household Expenses, and Other Income for an Existing Business

- Numbers for two references who are not blood relatives, along with their names and CNICs.

Punjab Rozgar Scheme Advertisement

Who can apply for e rozgar?

Punjab Rozgar Scheme Apply Online